- A Agarwalla & Co.

- GST & Customs

- August 8, 2023

Table of Contents

ToggleGST Evasion in India

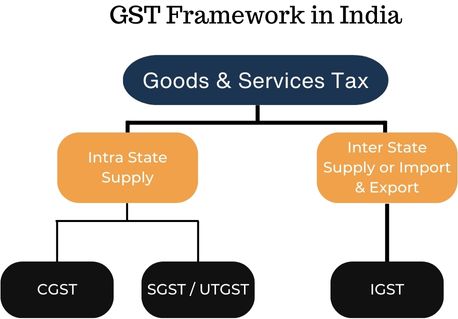

Goods and Services Tax (GST) implemented on 1 July 2017, represents one of the most profound fiscal reforms in the Republic of India. This reform is aimed at consolidating a multitude of indirect taxes into a singular and unified system. It was designed to enhance the ease of doing business, foster economic growth and augment the nation’s global competitiveness.

However, a critical analysis of the fiscal years spanning from 2020-21 to 2022-23 (up till May) unveils a disconcerting phenomenon: a significant proliferation of GST evasion in India across the national economic landscape. According to the data meticulously released by the Union Finance Ministry, the evasion of GST during this period amounted to an astonishing figure of ₹2,68,537 crore.

This monetary quantum manifests a rather troubling trend where unscrupulous traders and businessmen have exploited the complexities and nuances of the GST system. The GST Evasion in India techniques employed often involve the improper utilization of Input Tax Credit (ITC) which is a provision in the GST law that permits businesses to deduct the taxes paid on inputs from their tax liabilities.

As of the end of the aforementioned period, enforcement authorities have succeeded in recovering only ₹76,333 crore of the evaded sum. These actions have culminated in the apprehension and arrest of 1,020 individuals connected to various instances of GST Evasion in India thereby illuminating the scale and magnitude of this fiscal malfeasance.

It is imperative to recognize that GST evasion does not merely represent a statistical anomaly. Rather, it constitutes a grave legal and ethical infringement undermining the very fabric of fiscal governance and accountability. The evasion of GST weakens the nation’s revenue streams and disrupts the level playing field in the business environment.

The Issue with GST and Input Tax Credit (ITC) - GST Evasion in India

With its manifold advantages of GST, the system has exposed latent vulnerabilities as well. The fraudulent manipulation of Input Tax Credit (ITC) has emerged as a predominant issue and its examination requires a rigorous, analytical and legal approach.

The Mechanics of Input Tax Credit (ITC)

Input Tax Credit (ITC) is an essential component of the GST mechanism which enables businesses to deduct the taxes paid on the purchase of goods and services that are utilized in the furtherance of business. ITC is a legally sanctioned method for avoiding the cascading effect of taxes where tax is levied on tax and it fosters the creation of an economically efficient supply chain.

Exploitation of the ITC Mechanism

Despite the laudable intentions behind ITC, malevolent elements within the commercial sector have exploited its intricacies to perpetrate fraudulent activities. The modus operandi often involves:

- Creation of Fictitious Entities: Unscrupulous traders set up fictitious firms to generate and trade fake invoices without an actual supply of goods or services.

- Utilization of Fake Invoices: These fictitious invoices are utilized by other traders to claim ITC illegitimately thus leading to evasion of GST.

- Circular Trading: This involves a series of transactions among connected entities designed solely to inflate turnover and fraudulently claim ITC.

- Collusion with Banking Officials: Certain cases reveal collusion between private bank officials and traders to enable a well-organized racket.

A Specific Case of GST Evasion in India: The Chennai Incident

A conspicuous illustration of the foregoing malpractices is a case uncovered in the Chennai region. The Central GST Commissionerate in Chennai apprehended two individuals identified as key players in a GST Evasion in India scheme worth ₹33 crore.

In this particular instance:

- A former vice-president of a private bank and another person were implicated in establishing at least 20 fake firms.

- Fake GST invoices were fabricated and traded to 315 existing and fictitious firms amounting to ₹182 crore.

- The false ITC generated in this manner resulted in a loss of ₹33 crore to the GST revenue.

The issue with GST and the fraudulent manipulation of ITC is not merely an operational challenge; it reflects a significant legal infraction and an affront to the principles of fiscal propriety. The Chennai case elucidates the gravity and complexity of the situation and the alarming sophistication with which these schemes are executed.

Government’s Approach to Tracking GST Evasion in India

The proliferation of Goods and Services Tax (GST) evasion has necessitated an innovative and robust response from the Indian Government. The GST Evasion in India schemes which are often complex and vast in scale demand a multifaceted approach that combines traditional monitoring methods with cutting-edge technology.

#1 Monitoring Trends and Patterns

The Indian Government has established rigorous monitoring systems to identify, analyze and combat tax evasion trends. This encompasses:

- Central Monitoring Framework: Setting up dedicated anti-evasion wings within the Central Board of Indirect Taxes and Customs (CBIC) to detect and combat tax evasion.

- Coordination between States and Union Territories: Regular coordination meetings are held to assess state-level patterns and trends thus ensuring that knowledge and insights are shared across jurisdictions.

- Intelligence and Criminal Investigation Units: Establishment of specialized units to gather intelligence and conduct criminal investigations.

- Regular Scrutiny and Audit of Accounts: Scrutinization of tax returns, audit of accounts and real-time monitoring of large-value transactions have been regularized.

#2 Using Data Analytics and Artificial Intelligence

Recognizing the complexity of evasion schemes, the government has turned to sophisticated technological means such as:

- GST Analytics Division: The creation of a specialized division within CBIC utilizing data analytics to study tax compliance behaviour and detect anomalies.

- Artificial Intelligence Models: Implementation of AI models to identify potential fraud, generate alerts and predict future evasion patterns.

- Integration with Other Databases: Leveraging databases like the PAN (Permanent Account Number), Aadhaar and Corporate Affairs Ministry data allows for a more comprehensive analysis of tax compliance.

- Real-time Data Sharing with Enforcement Agencies: Enabling real-time data sharing among different enforcement agencies to ensure timely action against evaders.

#3 All-India Drives and Rule Changes

Nationwide drives and legislative measures form a critical part of the strategy:

- Nationwide Inspections: Regular All-India drives for the inspection of firms leading to significant detections. For instance, an All-India drive in 2020 led to the discovery of GST evasion in India amounting to over ₹2,000 crores.

- Legislative Amendments: Amendments to the CGST Act, imposing stricter penalties and creating non-bailable offences for certain types of GST Evasion in India.

- Enhanced Compliance Requirements: Introduction of e-way bills and mandatory Aadhaar authentication for GST registration, enhancing transparency and accountability.

- Targeted Campaigns: Specific campaigns targeting sectors with higher risks of evasion such as the manufacturing and service sectors.

From utilizing artificial intelligence to amending legislation, the multifaceted strategy reflects a strong commitment to upholding fiscal integrity and safeguarding national revenue. The continued evolution of these strategies aligned with the rapidly changing landscape of commercial activities will be paramount to maintaining the efficacy of the system.

Specific Amendments and Rules to Counter GST Evasion in India

The Indian government has continuously revised the Goods and Services Tax (GST) framework to proactively address challenges related to tax evasion. Acknowledging the fluidity and sophistication of evasion techniques a series of specific amendments and rules have been introduced focusing on registration processes, the availing of Input Tax Credit (ITC) and requirements related to bank accounts.

#1 Amendments in Rules for Registration

Enhanced Scrutiny in Registration (Amendment to Rule 8 of the CGST Rules, 2017):

- Introduction of mandatory Aadhaar authentication for GST registration to enhance the credibility of the verification process.

- Additional field verifications are now required where Aadhaar authentication is not possible.

Temporary Suspension of Registration (Amendment to Rule 21A of the CGST Rules, 2017):

- Provisions for immediate suspension of registration in cases where discrepancies or anomalies are detected in returns or other compliances, pending the completion of proceedings.

Introduction of Rule 9A in the CGST Rules, 2017:

- Requiring submission of additional information and documents for conducting proper physical verification of the business premises.

#2 Restriction on Availing of Input Tax Credit (ITC)

Amendment to Section 16 of the CGST Act, 2017:

- ITC can only be availed if the details are furnished by the supplier in the statement of outward supplies, reinforcing accountability in the transaction chain.

Introduction of Rule 86A to the CGST Rules, 2017:

- Authorities are empowered to restrict the utilization of the amount available in the electronic credit ledger if there are reasons to believe that ITC has been fraudulently availed.

Capping of ITC under Rule 36(4) of the CGST Rules, 2017:

- The ITC availed in respect of invoices not uploaded by suppliers cannot exceed 5% of the eligible credit, down from an earlier limit of 10%.

#3 Requirements Related to Bank Accounts

Amendment to Rule 10A of the CGST Rules, 2017:

- A stipulation that mandates the mentioning of bank account details in the GST registration within 45 days from the date of registration or the date on which the first payment is to be made, whichever is earlier.

Mandating Payments through Specific Bank Accounts:

- Proprietors must now make GST payments from the bank account mentioned in the registration form providing greater traceability and transparency.

Income Tax Department’s Efforts

The Income Tax Department in India has consistently strengthened its efforts to combat tax evasion by employing a multifaceted approach encompassing searches, seizures, legal proceedings, surveys and an innovative blend of non-intrusive methods. I. Searches and Seizures

The execution of searches and seizures remains a vital tool in uncovering and combating GST Evasion in India.

Search Operations

- 2018-2019: A total of 1,047 search operations were conducted unearthing undisclosed income of approximately INR 19,377 crores.

- 2019-2020: The Department conducted 983 search operations discovering undisclosed income amounting to INR 17,122 crores.

- 2020-2021: There were 1,051 search operations, resulting in the detection of undisclosed income of INR 20,353 crores.

Seizure Activities

- 2018-2019: Seized assets valued at INR 1,584 crores.

- 2019-2020: Assets worth INR 1,469 crores were seized.

- 2020-2021: Assets amounting to INR 1,617 crores were seized.

Cases and Convictions

The legal proceedings against tax evasion have shown a marked increase reflecting the Department’s intensified focus.

- Prosecution Cases:

- 2018-2019: 1,424 cases filed with 53 convictions.

- 2019-2020: 1,611 cases filed, culminating in 62 convictions.

- 2020-2021: 1,793 cases filed, leading to 78 convictions.

Surveys Conducted in the Last Five Years

Surveys have been an instrumental tool to assess and detect GST Evasion in India in various sectors.

- 2016-2021: The Department conducted a total of 12,835 surveys resulting in the detection of undisclosed income amounting to INR 38,686 crores.

Non-Intrusive Methods for Detecting Tax Evasion

The Department has also been progressively leveraging technology and data analytics as non-intrusive methods to detect evasion.

- Project Insight: Utilizes data analytics to detect relationships and patterns within large data sets aiding in identifying potential GST Evasion in India.

- Centralized Processing Center (CPC): Automation of various processes thus reducing human intervention and increasing efficiency in detection.

- Aadhaar-PAN Linking: Facilitates tracking of financial transactions through a centralized and integrated platform.

- Information Exchange Agreements with Foreign Jurisdictions: Enabling access to information on offshore accounts and investments.

These statistics and strategies bear witness to a robust institutional response that is both adaptive to contemporary challenges and reflective of the need for maintaining a balance between rigorous enforcement and taxpayer facilitation.

Conclusion

The success of these efforts will not only restore the integrity of the fiscal system but will also be vital in actualizing the core objectives of GST: a streamlined tax environment that stimulates economic growth and enhances India’s global competitiveness, thus combatting GST Evasion in India. The realization of these goals demands an unwavering commitment to principles of legality, accountability, and transparency, all of which must be rooted in a firm understanding of the evolving complexities of modern commerce.